The new “Basic” option for price-sensitive customers offers a lump-sum benefit starting at 20% invalidity. The “Smart” and “Best” options, on the other hand, do not stipulate any minimum degree of invalidity. Customers can also choose from several modules to suit their specific needs.

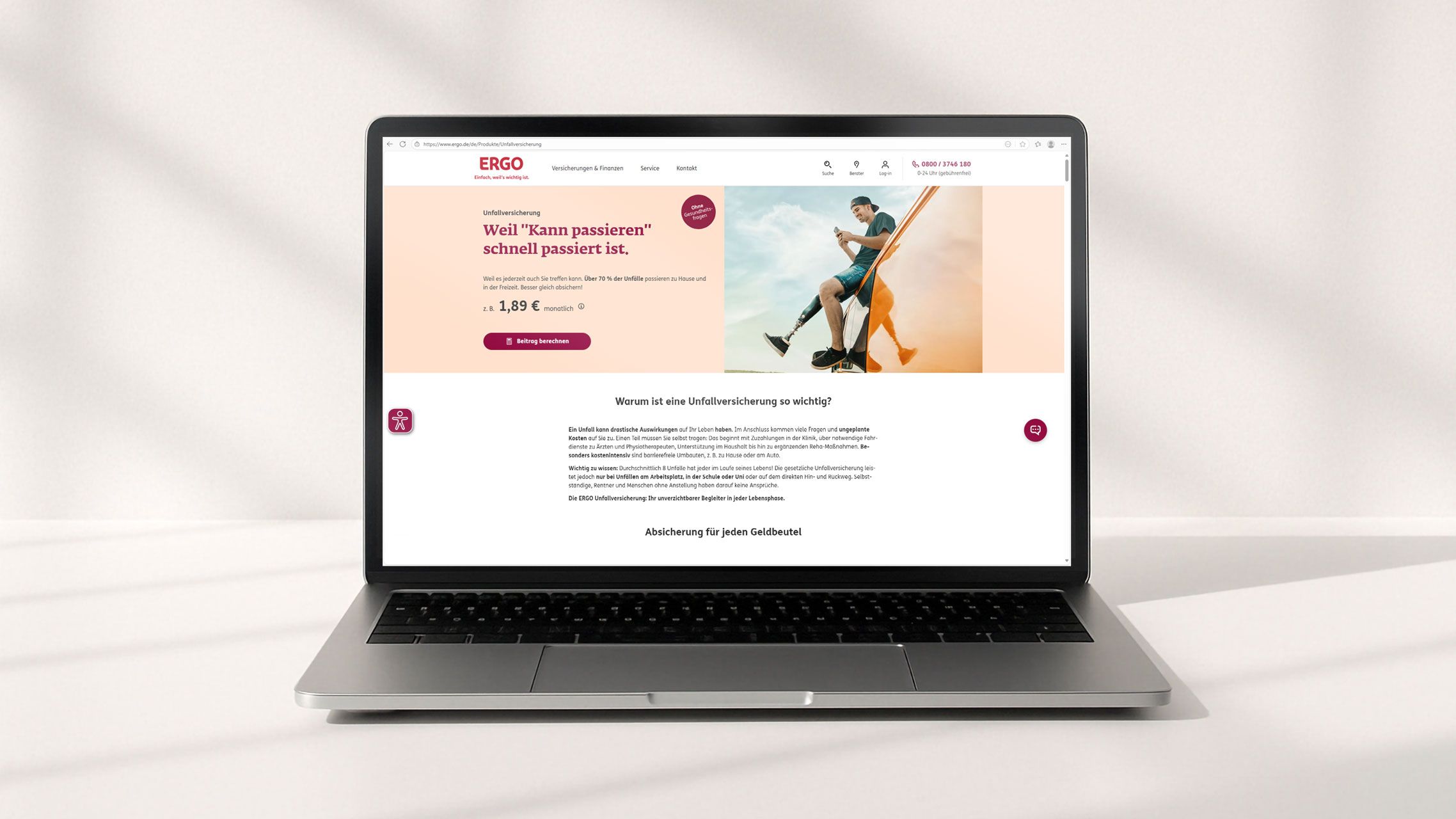

All-round protection with comprehensive accident assistance

The most popular module – ERGO Accident Assistance – is systematically geared towards policyholders’ day-to-day lives. Customers receive tailored assistance services from a home help service to childcare and help organising rehabilitation treatment. Assistance services can be agreed for a period of up to nine months, with cover provided for rehabilitation costs of up to EUR 150,000.